How to get a job as a Payroll Accountant?

To ensure success as a payroll accountant, you should demonstrate knowledge of applicable tax laws and ideally have experience in a similar role.

Begin by obtaining a bachelor's degree in accounting, finance, or a related field, and consider gaining practical experience through internships or entry-level positions in payroll departments. Acquiring relevant certifications, such as the Certified Payroll Professional (CPP), can enhance your credentials.

Stay updated on payroll laws and regulations, and tailor your resume and cover letter to highlight your payroll knowledge, software proficiency, and certifications.

Network with professionals in the field, search for job opportunities through various channels, and prepare for interviews by showcasing your technical expertise and soft skills such as attention to detail and communication abilities.

By following these steps and demonstrating your qualifications, experience, and dedication to the field, you can increase your chances of securing a job as a payroll accountant:

Search for Job Opportunities

Look for job openings in various sources, such as Emily Rice’s list, online job boards like Mandy.com, company websites, professional networking platforms like LinkedIn, and recruitment agencies specializing in accounting or finance roles. Additionally, consider reaching out to contacts in the industry or attending career fairs to explore potential opportunities. Revolution Entertainment Services organize Webinars from time to time, which will help you find the right resources to find jobs.

Obtain Payroll Certifications

Earning professional certifications can enhance your credentials and increase your chances of landing a payroll accounting job. Consider certifications such as the Certified Payroll Professional (CPP) offered by the American Payroll Association (APA) or other relevant certifications in your country.

Prepare for Interviews

Familiarize yourself with common payroll accounting interview questions and practice your responses. Here are some common payroll interview questions:

- How much experience do you have in payroll?

- What is your experience with the following payroll software? Which software are you most familiar with?

- What’s your experience with processing payroll for employees in different states?

- Have you ever had to resolve a payroll dispute with an employee? If so, how did you do it?

- What mistake do you see most often when processing payroll?

- What would you do if you made a mistake on an employee's paycheck?

- What do you think is the most important thing to keep in mind when processing payroll?

- What is your experience with reconciling payments?

- How do you keep up with changes in payroll laws like IRS regulations?

Be prepared to demonstrate your understanding of payroll processes, compliance, and problem-solving skills. Highlight your attention to detail, organizational abilities, and ability to work with confidential information.

Gain Relevant Education and Skills

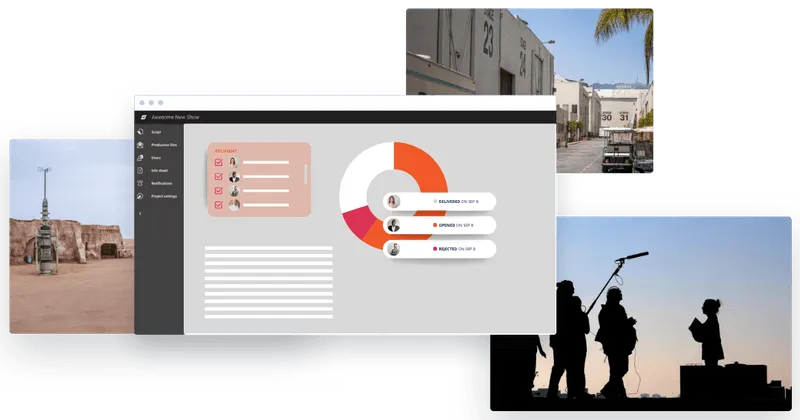

Obtain a bachelor's degree in accounting, finance, or a related field. Coursework in payroll accounting, taxation, and financial management can be beneficial. Acquire proficiency in accounting software, payroll systems, and spreadsheet applications commonly used in the field. Revolution Entertainment's Probooks is the next generation of production accounting which manually processes with easy data entry and reporting. With helpful features, controls, and an easy-to-use interface, ProBooks makes production accounting a breeze. Minimize manual processes with easy data entry and reporting. With useful features, controls, and an easy-to-use interface, ProBooks makes production accounting a breeze.

Build Experience

Seek opportunities to gain practical experience in payroll and accounting. Consider internships, part-time positions, or entry-level roles in payroll departments or accounting firms. This will help you develop hands-on skills and a deeper understanding of payroll processes.

Expand Payroll Knowledge

Stay updated on payroll laws, regulations, and best practices. Attend professional development seminars, webinars, and workshops conducted by Revolution Entertainment Services almost every week. Subscribe to industry publications and join professional associations like the APA to network with other payroll professionals and access educational resources.

Gain Multifaceted Experience

Seek opportunities to gain exposure to different aspects of accounting and finance beyond payroll. This could involve taking on additional responsibilities in areas like general accounting, financial analysis, or auditing. Diversifying your skill set can make you a more well-rounded and valuable candidate for payroll accounting positions.

Tailor Your Resume and Cover Letter

Highlight your relevant education, skills, and experience in your resume and cover letter. Emphasize your knowledge of payroll processes, software proficiency, and any certifications obtained. Customize your application materials to match the specific requirements and qualifications outlined in the job posting.

Develop Strong Analytical Skills

Payroll accountants often need to analyze data, identify trends, and provide meaningful insights. Focus on developing strong analytical skills, including the ability to interpret financial information, identify discrepancies, and generate meaningful reports.

Showcase Your Soft Skills

Succeeding in accounting and payroll isn't just about mastering computer skills and keeping up with labour laws. In addition to technical expertise, emphasize your soft skills such as attention to detail, analytical thinking, time management, and communication skills. These attributes are valued in payroll accounting roles as they involve working with numbers, managing deadlines, and collaborating with others. When you interview for accounting and payroll positions, the hiring manager will be evaluating how articulate, friendly, and cooperative you seem. They'll be looking to see if you'd be a good fit with the team and represent the company well with clients.

Follow Up After Interviews

After interviews, send thank-you notes or emails to express your gratitude and reiterate your interest in the position. This gesture demonstrates professionalism and can help leave a positive impression on the hiring manager.

Be Persistent and Patient

Building a successful career as a payroll accountant may take time. Be persistent in your job search, continuously improve your skills, and remain patient throughout the process. Stay focused on your long-term goals and be open to taking on new opportunities that can contribute to your growth as a payroll accountant.

Demonstrate Ethical Conduct

Ethical conduct is crucial in the field of payroll accounting. Uphold ethical standards, maintain confidentiality of employee information, and ensure compliance with relevant laws and regulations. Demonstrating ethical behavior and integrity is essential for building trust with employers and clients.

Stay Updated on Technology

Payroll accounting is becoming increasingly reliant on technology. Stay updated on payroll software, timekeeping systems, and other technology tools commonly used in the field. Familiarize yourself with cloud-based payroll systems, automation, and data analytics tools to enhance your proficiency and efficiency.

Revolution Entertainment Services has the following software which could help you with your accounting needs and make the process faster and easy.

ProPay

Revolution, as the statutory employer, processes payroll for the motion picture industry. Payroll Coordinators use ProPay, to process the payroll, which involves data entry, calculating timecards, cutting checks and issuing W-2s, billing, among other things.

Seek Mentorship

Find a mentor who is an experienced payroll accountant or works in a similar role. A mentor can offer guidance, share insights, and help you navigate your career path. Their expertise and advice can be invaluable as you progress in your payroll accounting career. Revolution Entertainment Services has a pool of Production Accountants who offer their expertise from time to time.